Do You Pay State Taxes On Casino Winnings

- Do You Pay State Taxes On Casino Winnings Money

- Do You Pay State Taxes On Casino Winnings Payouts

- Do You Pay State Taxes On Casino Winnings Jackpot

- Do You Pay State Taxes On Casino Winnings Tax

Tax: Gross Income Tax Under the provisions of N.J.S.A. 54A:5.1(g), all gambling winnings, whether they are the result of legalized gambling (casino, racetrack, etc.) or illegal gambling, are subject to the New Jersey Gross Income Tax. New Jersey Lottery winnings were not taxable for New Jersey Gross Income Tax purposes prior to 2009. The federal government taxes gambling winnings at the highest rates allowed. So do the many states and even cities that impose income taxes on their residents. If you make enough money, in a high-tax state like California or New York, the top tax bracket is about 50 percent. Casino Winnings Are Not Tax-Free Casino winnings count as gambling income and gambling income is always taxed at the federal level. That includes cash from slot machines, poker tournaments.

Gambling is fun. Taxes are not. Unfortunately, the two have to go together for anything to happen.

The truth of the matter is that for states like Michigan, the only real reason to legalize any form of gambling is the opportunity for tax revenue. Whether it be to pay for schools, roads, or some other unspecified project, most governments are always on the lookout for a new revenue stream.

Paying any taxes stings, to be sure. However, it’s important that you know how and when the taxman might come when you visit one of Michigan’s casinos. So, here is a guide for how taxes apply to Michigan gambling.

What is taxable in Michigan?

Throwing money around in a casino rarely seems like an official transaction. Whether you win or lose, the final disposition of your chips can often feel like a stitch in time.

Unfortunately, it’s not. All winnings that you realize in a casino are taxable as income, both on the state and federal levels.

So, you should be reporting those wins on your annual tax returns. Though many people scoff at the notion of reporting cash income to the government, it counts the same as income from a check or direct deposit in the eyes of the taxman.

Failure to report your gambling income could, in theory, land you in hot water with the Internal Revenue Service (IRS) or the state of Michigan’s tax office. In practice, those entities are unlikely to audit someone over a few hundred or thousand dollars, but that doesn’t mean that they can’t or won’t do so.

Also, please take note that non-cash winnings, like cars, boats, or other objects that you may win at a casino are subject to taxes too. The value that has transferred to you because of the win has increased your financial position, and the government wants its share of the loot. As a side note, game show prize winners have to do the same thing.

What taxes will I have to pay in Michigan?

Now that you’ve steeled yourself to the reality of giving away a portion of your sweet winnings to the government, you may be wondering who and what you’ll be forced to pay. As indicated earlier, you will be compelled to pay percentages to both the IRS and the state of Michigan for your wins there.

The IRS, for its part, will demand that you fork over 25% of your winnings to the feds for your troubles. This rate applies to wins of any size, so even if you win just a dollar, you’ll still need to throw a quarter at the taxman.

In addition, Michigan law requires that you pay an additional 4.25% to the folks in Lansing for having played in their casino. Even though the casinos themselves are the main wellspring of tax income for the state lawmakers, gamblers do not escape unscathed.

For smaller wins, you’ll essentially be on your honor to report your gambling winnings to the appropriate authorities. As stated earlier, it’s not legal just to stick the money into your pocket, but there’s no mechanism or watchful eye to force your compliance as you exit the casino.

That lack of oversight extends to wins up to $5,000. However, at that point, the casino itself is bound to collect 25% on the government’s behalf before it releases your winnings to you. Give the cage your name and Social Security number, and your tax bill will be settled before you leave the property.

Obviously, losing 25% off the top is a kick in the teeth, but please don’t get any ideas about simply withholding your name and SSN. As it turns out, anyone who refuses to provide their information (for any reason) will be subject to an additional penalty of 3%.

Neither option is good, but bear in mind that the casino is not going to keep a cent of that money that it withholds. So, you might as well go along with it and live to fight another day.

If I never win $5,000, will I ever have to pay taxes upfront?

If you’re not a high roller, the idea of ever reaching the federal threshold for casinos to report wins might seem far-fetched. After all, if you usually bet in $5 or $10 increments, it’s quite unlikely that you’ll realize a win that exceeds $100, let alone $5,000.

So, you may be wondering if you’d ever have to worry about the feds ever knowing that you were gambling. Unfortunately, there are some other scenarios in which the casino might have to report your win to the IRS before handing you the proceeds from your hard-fought victory.

A casino must report a win to the IRS with Form W-2G if any of the following events occurs:

- The total winnings, or combined bet and profit, on a slot machine exceed $1,200.

- A player’s keno profit on a game is more than $1,500.

- A poker player wins more than $5,000 in a tournament.

- A game’s profit is more than $600 and is thirty times or greater than the bet amount.

Now, filing this form does not mean that the casino has to collect from your winnings automatically. However, since the government will soon be aware of your win, it would be foolish to omit it from your return. So, make sure to keep your copy of the form for your records.

The bottom line is that if you have a memorable win in a casino, it’s quite likely that the government wants to remember it, too.

How do I report my winnings?

It’s understandable that you might feel disappointed about having to pay taxes on your winnings. Nevertheless, in most cases, you’ll bite the bullet and decide to file. So, here’s how to do that.

As is the case for essentially anything to do with the IRS, there are forms to fill out. The first thing to do is report the income on the IRS Schedule 1, which is the form for additional income and adjustments to income.

On that form, look for Line 8 in Part I, which is entitled “other income.” Here is where you will list your winnings and their source. “Gambling” or “casino” are fine for explaining from where the money came in most cases, although you can be more specific regarding the casino and date if you’re worried about attracting attention.

Once you’ve entered the information onto your Schedule 1, you’ll need to put the same total onto line 7a of your regular tax return. You will then be able to add the winnings into your overall taxable income.

By the way, your Schedule 1 is also the place to list various types of deductions, like certain business expenses or student loan interest payments. So, make sure that you don’t miss out on all the different ways to knock down that taxable base.

Can I report gambling losses in any way?

Of course, gambling comes with the inherent chance of losing. However, you could understandably think that it seems unfair that the IRS only cares about your winnings. You may wonder if there’s a way to claim gambling losses on your taxes.

As it turns out, you can.

The IRS provides Schedule A as a form to claim various deductions. Although there’s no line expressly for gambling losses, you can list your setbacks in Box 16 – Other Itemized Deductions to claim them.

Now, there are two rules that go along with claiming casino losses on your tax form. The first, and most important, is that you cannot claim losses in excess of your claimed winnings.

So, if you list $1,000 in gambling winnings on your Schedule 1, the maximum that you could claim as losses on your Schedule A would be $1,000. If you had a bad year at the casino (as many of us do), the IRS does simply allow you to write off the loss as a deduction against your taxable base, unfortunately.

The other rule is that you must be able to prove your losses in some kind of meaningful way in order to claim them. It is vital that you keep records, receipts, and other documentation to show the losses, or the IRS might not accept the deduction as valid.

After all, that might be a handy way to offset your winnings from the year and avoid taxation, so the IRS has to be sure that you took the beating you claim to have suffered. The chance that the agency will take a harder look at you will increase as the dollar amount goes up, so if you’re a bit of a high roller, it’s a good idea to keep a paper trail for yourself.

If you’re thinking that record-keeping might be a pain, you can possibly make things easier by using your loyalty or membership card at your casino of choice when you play. Since they award you based on your play, they keep records of your play. It shouldn’t be too difficult to acquire a copy of your history from the casino.

For your Michigan tax return, it is not possible to claim any kind of losses as a deductible expense. However, the state does allow you not to report the first $300 you win on bingo, poker, or other games from your total household expenses.

Do I have to pay taxes if I don’t live in Michigan?

It’s pretty clear that you have to pay taxes to Michigan if you’re a Michigan resident. However, you may be wondering if you’re still on the hook for the taxes if you’re just visiting from out of state.

Unfortunately, you are still bound to pay taxes to Michigan for your gambling win as a nonresident. As is often the case, there’s even a form for that. Worse yet, you will also have to report your winnings on your return for your own state, assuming that your state requires an income tax.

Do You Pay State Taxes On Casino Winnings Money

However, there are a couple of bits of good news. First of all, the states nearest Michigan (Illinois, Indiana, Kentucky, Minnesota, Ohio, and Wisconsin) have reciprocal agreements with the Great Lake State regarding earnings that you incur in Michigan. If you live in one of those six states, you are not required to file a nonresident return in Michigan.

The other ray of sunshine is that there is, in fact, a tax credit that you will be able to claim on your home state’s return that will offset the taxes you paid in Michigan on your winnings. So, even though you had to fork over to a state in which you don’t live, you don’t have to pay double tax on the windfall. Although states are happy to collect tax revenue, they correctly realize that having to pay tax twice on the same win might lead citizens to decide it’s not worth the effort to play.

Do I have to pay taxes if I’m part of a group?

In many things, there is strength in numbers, and gambling is no exception. It’s not uncommon for a group of friends to pool their money so that they can roll a bit higher than they would individually. Whether they’re throwing in for a slot machine or on a lottery ticket, groups of people can often find themselves with a claim to a significant amount of winnings.

Unfortunately, taxes remain one of life’s surest things, and group wins are subject to taxation just as much as individual wins. As expected, there is a form for that.

If your group of friends scores big, you will need to fill out IRS Form 5754 to report the winnings for tax purposes. One of the group will have to designate himself or herself as the primary winner, and the other members of the group will have to note the share of the prize that they are claiming. So, if you hit it big with your buddies, you might need a calculator.

Once you’ve got the form filled out, send it to the IRS. If the win occurs at a casino, casino management might want a copy of the form for its own records, too.

Advertiser Disclosure

Advertiser DisclosureWe think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

This article was fact-checked by our editors and reviewed by Christina Taylor, MBA, senior manager of tax operations for Credit Karma Tax®.

Betting on sports is part of the fun for many sports fans — even if their wagering hasn’t always been technically legal.

Until a May 2018 U.S. Supreme Court decision opened the door for every state to legalize sports betting, just four states allowed wagering on sports — Nevada, Delaware, Montana and Oregon. Legality, however, hasn’t stopped Americans from betting on sports. In fact, the American Gaming Association estimates that Americans spend more than $150 billion a year on illegal sports betting.

Since the Supreme Court’s ruling, New Jersey, Pennsylvania, West Virginia, Mississippi and Rhode Island have legalized sports betting. And at least 14 other states are considering laws to permit wagering on sports.

But when you gamble on sports, it won’t matter to the IRS if your winnings came from a legal bet or from one that’s off the books. Your winnings are taxable income either way.

If you plan to do some wagering in a state that’s legalized sports betting, it’s important to understand how tax on your winnings will work. Let’s take a look at how the IRS treats gambling winnings of any kind.

Sports-betting winnings are taxable income

The big question for sports gamblers: Are your winnings taxable income? As we said above, the answer is yes.

“Gambling winnings are fully taxable and you must report the income on your tax return,” the IRS says. “Gambling income includes but isn’t limited to winnings from lotteries, raffles, horse races and casinos. It includes cash winnings and the fair market value of prizes, such as cars and trips.”

Although sports betting isn’t one of the examples, it’s still covered by “gambling winnings.”

Whether sports betting is legal in the state where you place your bet doesn’t matter to the IRS. If you win, you have taxable income, which should be reported when you file your tax return.

These rules apply only to casual sports bettors. If you’re a pro — “in the trade or business of gambling,” as the IRS puts it — different rules apply.

How much tax you’ll owe depends on your personal tax situation and tax bracket.

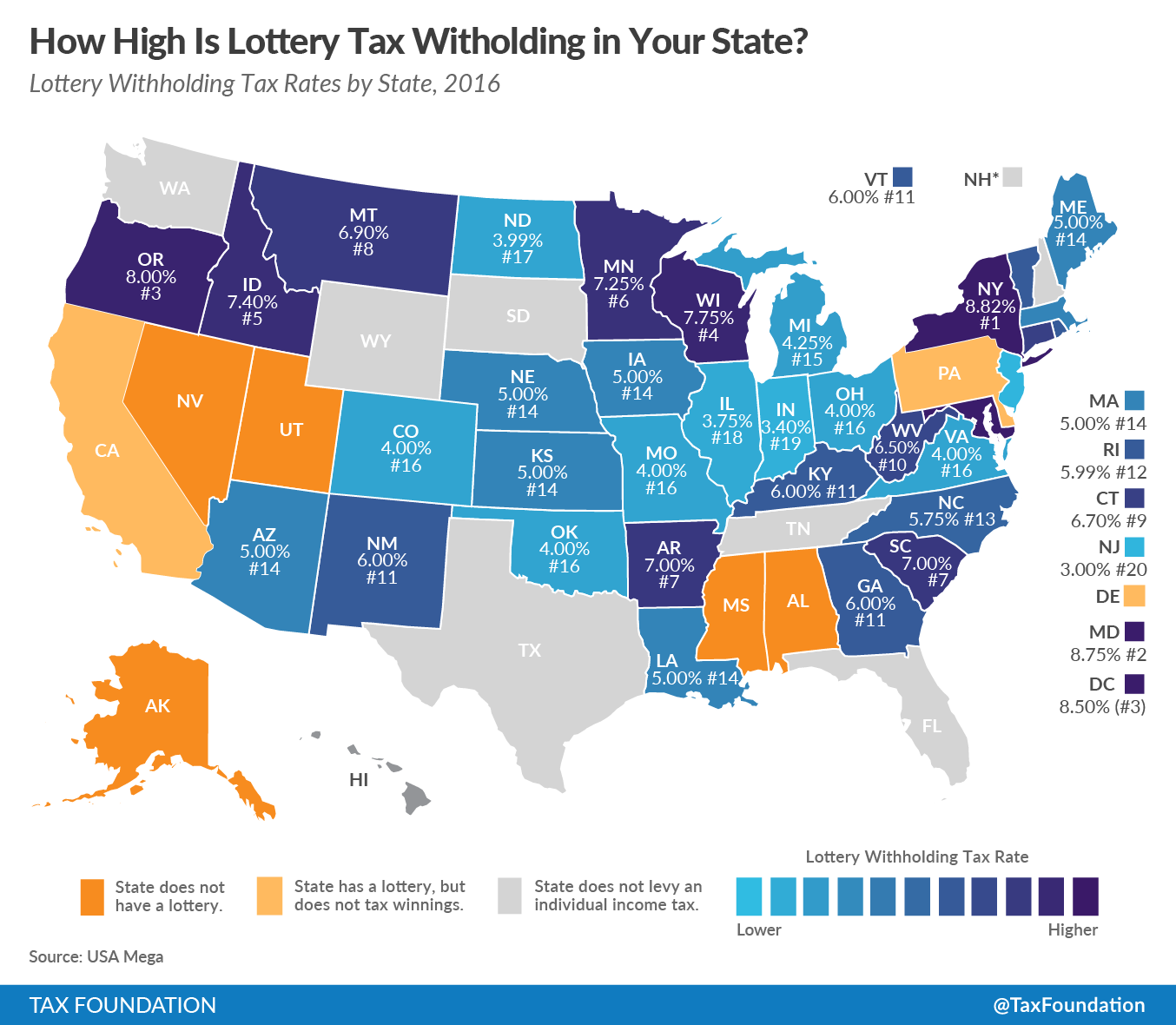

You might also owe state income tax on any money you win from betting on sports, depending on which state you live in. For example, Nevada doesn’t have a state income tax. But Maryland does, and it considers winnings from gambling taxable income. If you win money betting on sports, check with your state to see if it taxes gambling winnings.

What types of income are taxable?Form W-2G: Evidence of your sports-betting win

So you win a couple thousand bucks betting on your favorite sports team. How will the IRS know if you don’t tell it? Well, whomever you won the money from — a casino, racetrack, etc. — is supposed to report your winnings to the IRS on Form W-2G. The form tells the IRS some important information, including …

- Contact information for the payer who awarded you the winnings, including phone number, address and federal tax identification number

- Your name, address and taxpayer identification number

- How much you won

- When you won it

- What kind of wager you made

- And how much, if any, federal and state income tax the payer withheld from your winnings

Do You Pay State Taxes On Casino Winnings Payouts

Generally, the payer has to report your winnings if …

Do You Pay State Taxes On Casino Winnings Jackpot

- You won $1,200 or more from a bingo game or slot machine

- You raked in $1,500 or more at keno

- Your poker victory tops $5,000

- You won $600 or more and your winnings are at least 300 times the amount of your bet (bingo, slots, keno and poker are exceptions to this rule)

- The payor withheld federal income tax on the winnings

Penalties for not reporting sports-betting income

Of course, the IRS wants you to report all your taxable income, and if you don’t you could face penalties and interest on any tax you owed but didn’t pay.

Generally, the penalty for not paying income tax that you owe is 0.5% of the unpaid tax. That rate is assessed monthly until you pay the tax you owe. Unpaid tax and penalties typically accrue interest, too — 5% compounded daily from the due date of your tax return to the date when you actually pay in full the balance of any tax, penalties and interest you owe.

However, if you’re caught intentionally omitting income — like gambling winnings — from your tax return in order to avoid paying tax on that income, it could mean additional penalties. According to the tax code, trying to “evade or defeat” tax you owe on income you’re required to report could be a felony with fines of up to $100,000 for individuals or five years in prison. Plus, people convicted of tax evasion can be held responsible for the costs of prosecution.

What should you do if you can't pay your taxes?Lose a sports bet? It might be deductible!

Just as sports-betting winnings are considered taxable income, losses may be tax-deductible if …

- You itemize your deductions

- You keep detailed records of your winnings and losses

“To deduct your losses, you must keep an accurate diary or similar record of your gambling winnings and losses and be able to provide receipts, tickets, statements or other records that show the amount of both your winnings and losses,” the IRS says.

Any losses you deduct cannot exceed winnings that you report when you file your return. For example, if you reported winnings of $5,000, you could deduct losses only up to that amount. Additional losses would not be deductible. And if you lost $5,000 but didn’t win anything, you wouldn’t be able to deduct those losses at all.

If you’re eligible to deduct your sports-betting losses — or any other gambling losses — you’ll do so on Schedule A, Line 28, “Other Miscellaneous Deductions.”

Bottom line

More than a quarter of Americans like to bet on football, 21% are interested in betting on baseball or basketball, and 20% would put some money down on a hockey game, according to Nielsen Sports. If you’re a fan of sports wagering, it’s important to understand that tax on sports betting is nothing new.

The IRS has always considered gambling winnings taxable income, and it expects you to report all your taxable income — even the money you win betting on sports.

If you’ll be reporting gambling winnings on your federal income tax return, or hoping to write off some gambling losses, be sure to keep detailed records of your wagers and losses.

Christina Taylor is senior manager of tax operations for Credit Karma Tax®. She has more than a dozen years of experience in tax, accounting and business operations. Christina founded her own accounting consultancy and managed it for more than six years. She co-developed an online DIY tax-preparation product, serving as chief operating officer for seven years. She is the current treasurer of the National Association of Computerized Tax Processors and holds a bachelor’s in business administration/accounting from Baker College and an MBA from Meredith College. You can find her on LinkedIn.